Prices for bitcoin skyrocketed to the $97,000 level today, increasing more than 2% and closing in on the symbolic $100,000 level. The cryptocurrency is in its continuing surge that has gotten investors enthusiastic so far in 2025.

Market Old Timer Forecasts Significant Price Target

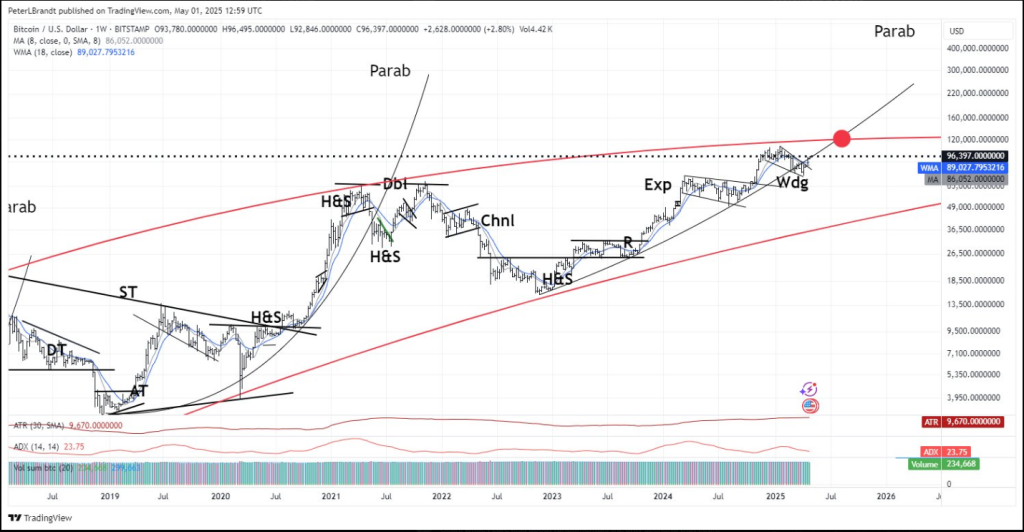

According to trading analyst Peter Brandt, Bitcoin may rise to $125,000 to $150,000 come late summer or early autumn. His forecast, made in social media posts a few hours prior to this report, is that the increase may occur in August or September 2025.

This is based on Bitcoin successfully re-taking what Brandt refers to as its “parabolic trendline” – a technical chart pattern which demarcated earlier price cycles.

The prospective move from the present levels near $96,000 to Brandt’s higher target of $150,000 would amount to a 56% return for buyers at today’s prices.

Hey @scottmelker

If Bitcoin can regain the broken parabolic slope then $BTC is on target to reach the bull market cycle top in the $125k to $150K level by Aug/Sep 2025, then a 50%+ correction pic.twitter.com/WUUzxl0ckn— Peter Brandt (@PeterLBrandt) May 1, 2025

Technical Analysis Indicates Multiple Patterns

According to Brandt’s weekly chart analysis, Bitcoin is presently rising within what he sees as a bullish wedge formation. The cryptocurrency is also still within a long-term rising channel that has been holding price in check over the past few years.

His chart also shows certain technical patterns that preceded Bitcoin price movements in history such as Head and Shoulders, Channels, and Expanding Triangles-all basic trends among technical traders.

Timing In Accordance With Historical Halving Cycles

The predicted high peak for Bitcoin in 2025 from August to September is in accordance with what has taken place after these past halving events. Those halvings – reducing the rate of new Bitcoins created – were always followed by price highs 12-18 months later.

With the last halving occurring in April 2024, Brandt’s prediction is well within this likely timeframe. This association with Bitcoin’s supply dynamics makes some traders believe the forecast.

Warning Of Severe Correction Following Peak

Interestingly, the market expert has not merely predicted a high. Brandt believes Bitcoin could plunge dramatically, by more than 50%, after the top of its cycle, possibly taking prices all the way back down to $60,000-$75,000.

While Bitcoin’s current price actions show strong upward momentum, seasoned investors know the market can change direction pretty quickly; 24/7 trading and worldwide participation has sometimes contributed to speed of execution and rapid price changes that would take unprepared traders by surprise.

For the moment, however, Bitcoin’s race toward $100,000 is still attracting attention from longer-term believers and first-timers alike, hoping to cash in on what could be yet another historic run in cryptocurrency markets.

Featured image from Unsplash, chart from TradingView