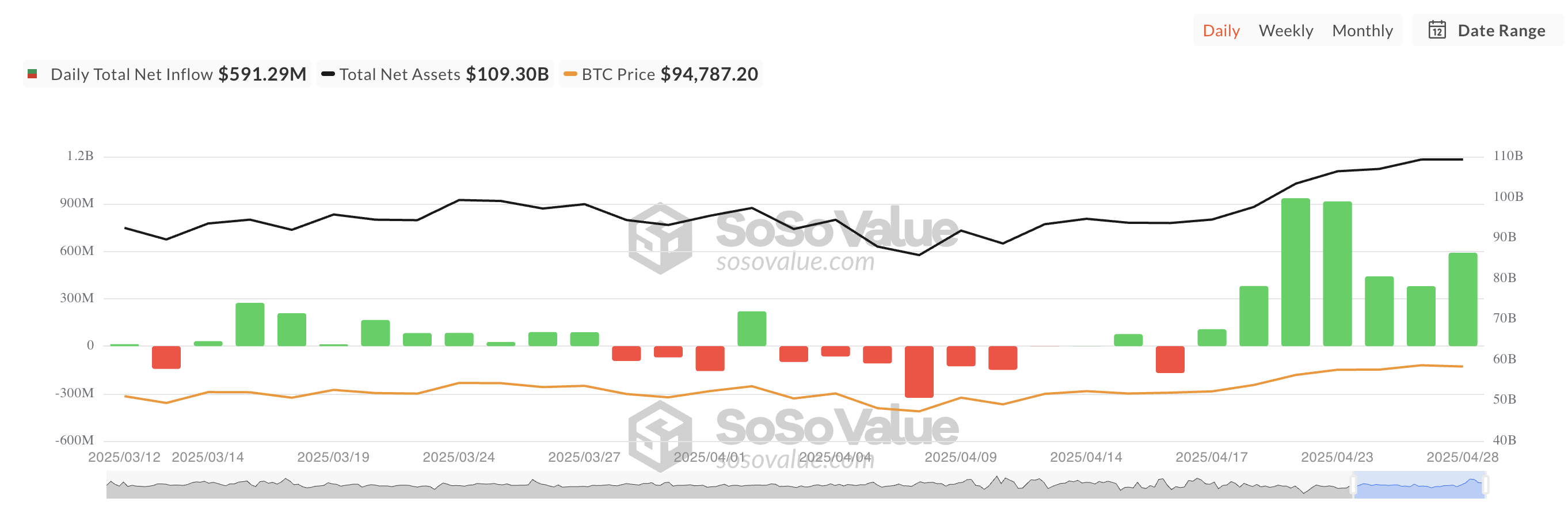

Bitcoin exchange-traded funds (ETFs) continued their inflow streak on Monday, raking in over $500 million in fresh capital and marking seven consecutive days of positive flows.

The sustained momentum reflects the resurgence in investor appetite for BTC exposure through regulated investment vehicles, even amid broader market volatility.

BTC ETFs See Steady Inflows

On Monday, BTC spot ETFs attracted fresh investor demand, recording $591.29 million in net inflows and extending their winning streak to a seventh consecutive day. This happened as the leading coin sought stable support above the $94,000 price.

Once again, BlackRock’s iShares Bitcoin Trust (IBIT) led the charge, recording the largest inflow among its peers. The fund saw inflows totaling $970.93 million, bringing its total cumulative net inflows to $42.17 billion.

ARKB, the BTC spot ETF managed by Ark Invest and 21Shares, recorded the largest net outflow yesterday. On Monday, $226.30 million exited the fund. Despite this setback, ARKB’s total historical net inflow remains at $2.88 billion.

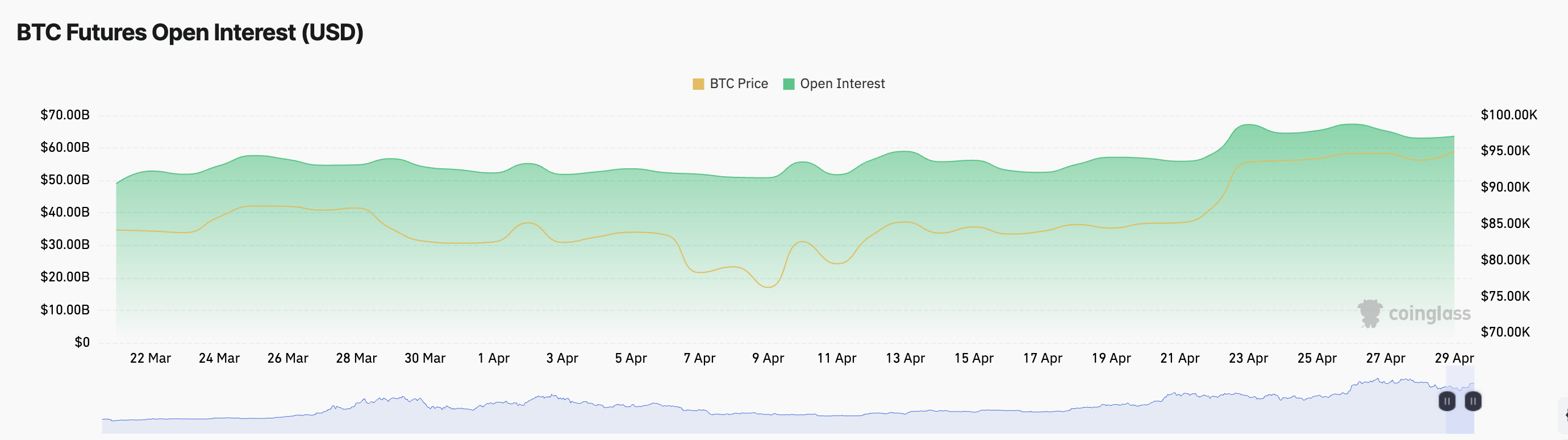

Rising Open Interest and Bearish Options Sentiment Set the Stage

Open interest across BTC’s futures market has risen by 2% over the past day, signaling an increase in outstanding futures contracts. The coin’s price has noted a modest 0.14% uptick during the same period.

A rise in open interest indicates that more traders are opening new positions rather than closing existing ones. This bullish signal can strengthen BTC’s price rally in the short term.

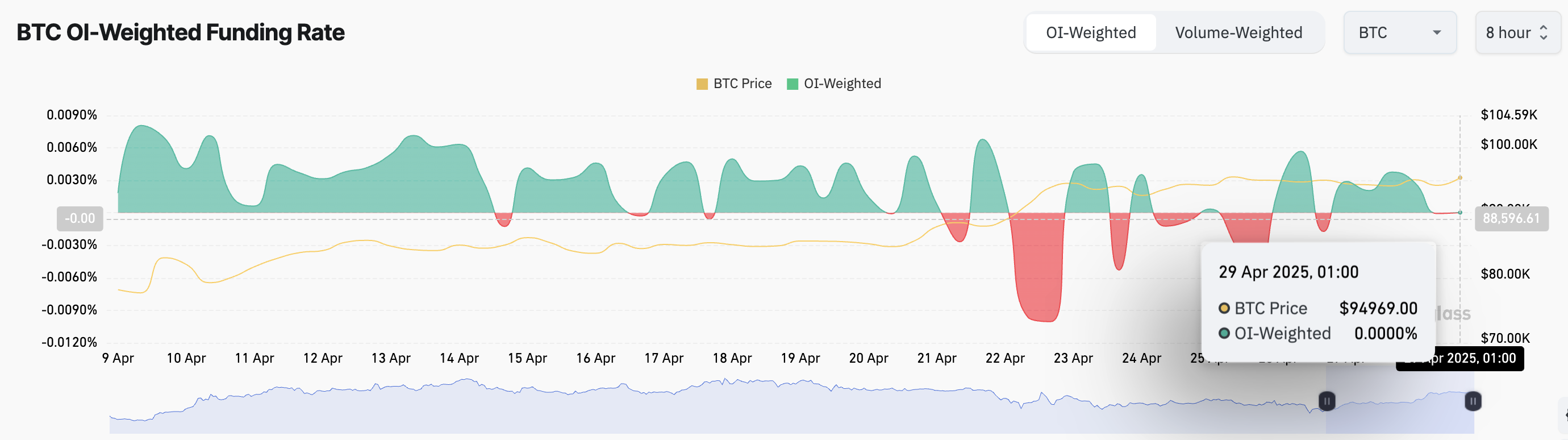

Meanwhile, as of this writing, BTC’s funding rate is 0%, indicating a balanced market between long and short positions. A neutral funding rate like this suggests no immediate dominance by bulls or bears in the coin’s perpetual futures market.

This reduces the likelihood of sudden liquidations, meaning any major price movement would likely need fresh momentum rather than being triggered by leverage-driven squeezes.

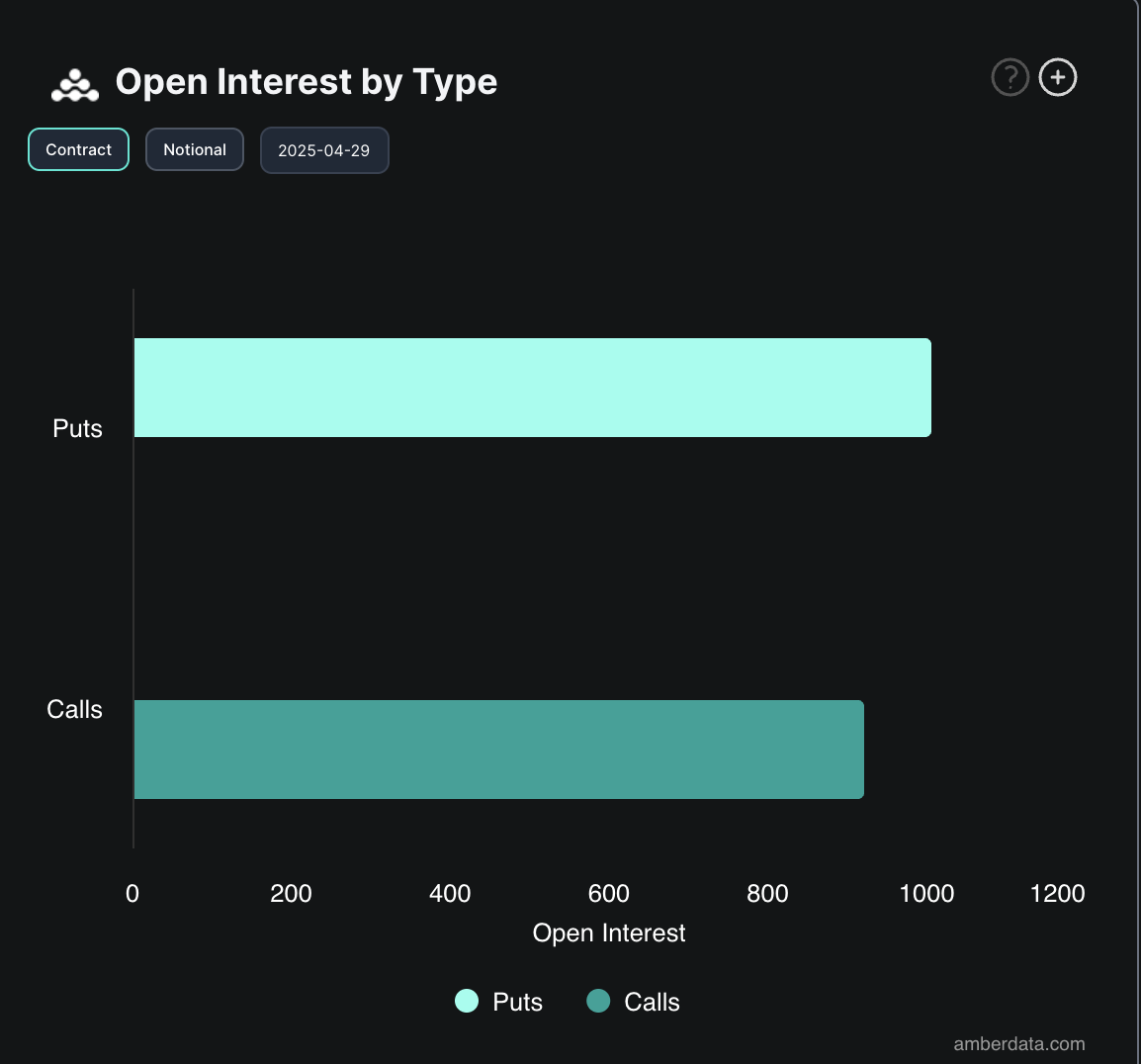

However, the sentiment among BTC options traders is clear. Today’s high demand for puts indicates a more cautious or bearish outlook among BTC options traders.

The growing interest in these bearish contracts suggests that many investors anticipate a potential pullback in BTC’s price, despite the recent inflows into Bitcoin ETFs.

Until a clear breakout or breakdown occurs, BTC may continue to consolidate within the narrow range.

The post Bitcoin ETFs Celebrate a Week of Wins, But Trouble Brews in the Derivatives Market | ETF News appeared first on BeInCrypto.