TL;DR

- CRV breaks out of 3-month channel, surges past $0.85 resistance on heavy buying volume.

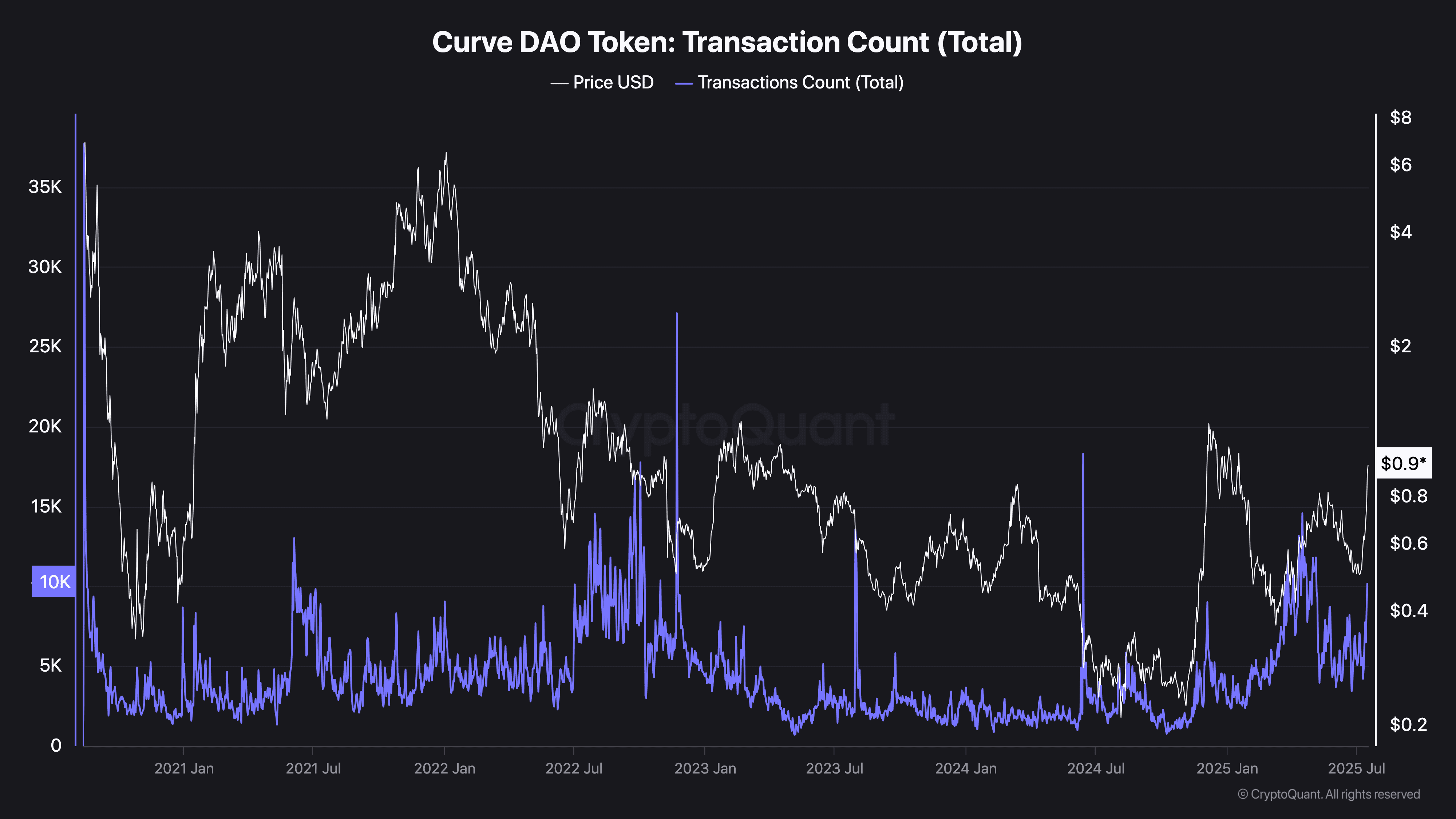

- Daily transactions jump above 10,000, confirming growing network activity alongside rising price momentum.

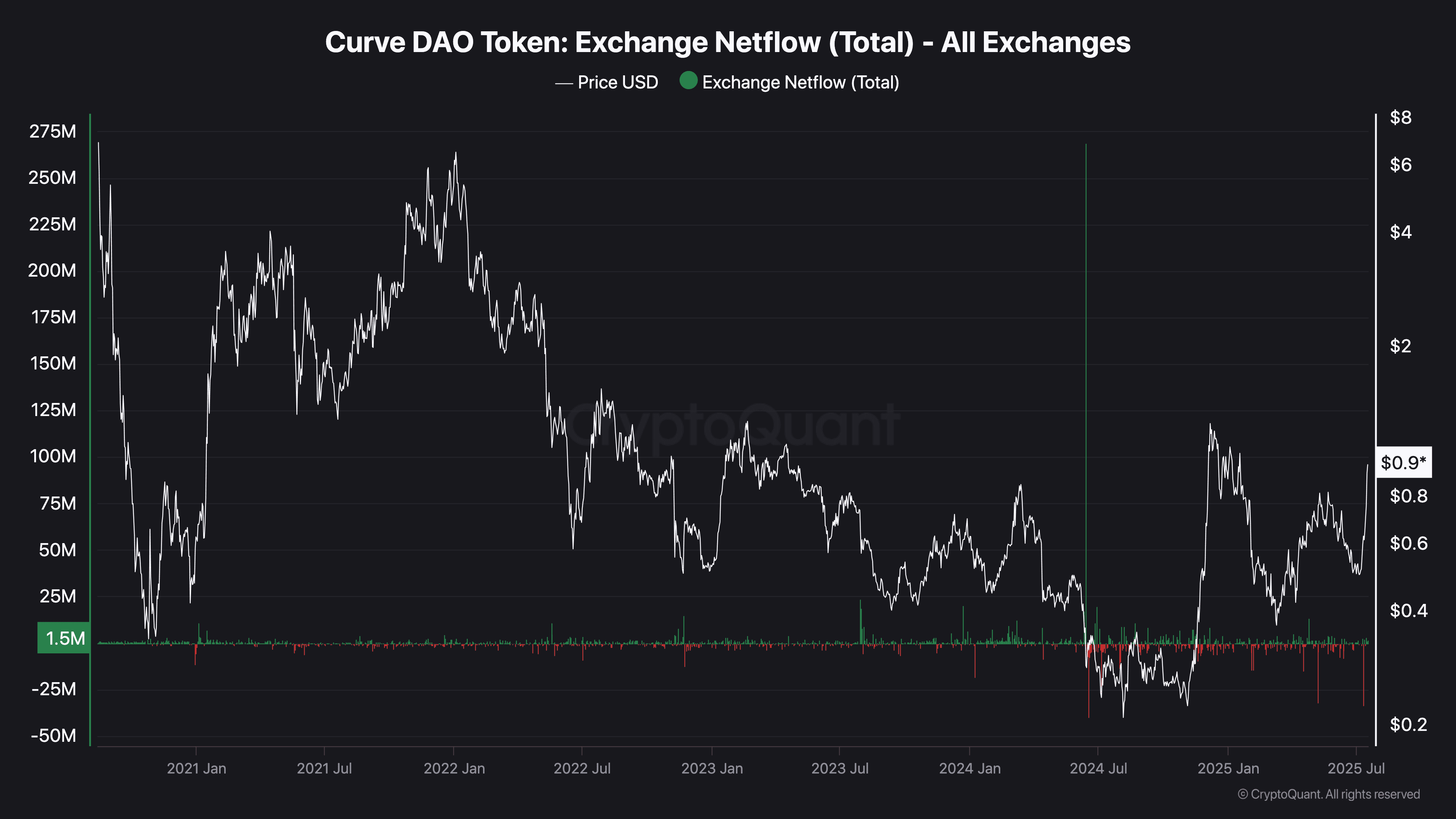

- Over 50 million CRV withdrawn from exchanges, signaling potential long-term accumulation.

CRV Breaks Past Key Price Zone

Curve DAO’s CRV token jumped more than 22% over the past day, trading at $0.96. The move adds to its 7-day rally of over 70%, placing it among this week’s top performers. Volume also surged, with over $833 million in daily trades.

Looking at the chart, there is a clean breakout from a downward channel that had been in place since early May. CRV also cleared a horizontal resistance area between $0.80 and $0.85. According to market analyst Alpha Crypto Signal,

“As long as CRV holds above the previous resistance, the momentum remains with the bulls.”

#CRV HTF Analysis:$CRV has broken out of a descending channel and cleared the horizontal resistance zone. $CRV exploded with strong volume, confirming a bullish breakout. Now, a retest of the breakout zone would offer a solid long opportunity.

As long as $CRV holds above the… pic.twitter.com/0IW43tE57U

— Alpha Crypto Signal (@alphacryptosign) July 17, 2025

Technical Signals Still Point Up

The token trades well above its 9-day EMA at $0.74 and its 50-day SMA at $0.6116. Both moving averages are rising, showing firm upside momentum. The breakout candle closed above resistance, a move often viewed as a sign of buying strength.

Notably, the next area to watch is a possible retest near $0.85. If the price holds there, buyers may aim for a push toward $1.05. Resistance sits around $0.995, while support lies at $0.775 and $0.56 based on recent trading ranges.

Transaction Count Rises with Price

Curve’s on-chain activity has picked up. Daily transaction count recently rose above 10,000, a level not seen in months. This uptick in usage matches CRV’s sharp price increase, reflecting stronger network participation.

Data from early July shows consistent growth in network activity. If this trend holds, it could help support CRV’s current valuation and any further moves up.

Exchange Outflows Suggest Accumulation

More than 50 million CRV tokens have been moved off exchanges in recent days, based on CryptoQuant figures. That’s the largest outflow recorded this year. Overall, CRV has seen steady withdrawals since January.

Historically, large inflows have been followed by price drops, while outflows have come ahead of rallies. With tokens leaving exchanges and prices rising, some traders believe long-term holders are positioning ahead of potential continuation.

The post Curve DAO Explodes 70% in a Week—What’s Fueling CRV’s Run? appeared first on CryptoPotato.