Key Insights:

- BNB has traded near $600 and approached key resistance between $609 and $620.

- VanEck files for a U.S.-based BNB ETF, signaling growing institutional interest.

- On-chain data shows rising inflows, with smart money leaning bullish despite retail doubt.

Binance Coin (BNB) has approached the $620 resistance zone as VanEck applies to a U.S.-based BNB ETF. The move aligns with a 16% increase in trading volume and price stabilization. Despite short-term price pressure, institutional interest in the asset remains strong.

BNB Hovers Near Resistance With Eyes on $620 Breakout

BNB was trading at $598 when writing, up 2.03% in the last 24 hours. The price has been slowly edging closer to a critical resistance zone between $609 and $620, which has held since March. According to Crypto Rand, breaking above this range could open the door for a reversal.

During this sideways consolidation, volume has been consistent. On the 3-day chart, BNB has tested the upper edge of a descending trendline.

The $560 zone has consistently acted as a strong support in past sessions. A breakdown below this level could trigger a retest of the $500–$514 range.

ETF Filing Puts BNB on Institutional Radar

Meanwhile, the country’s first BNB ETF has been filed by VanEck in a Form S-1 with the U.S. SEC. If approved, the “VanEck BNB ETF” would offer U.S. investors regulated exposure to BNB.

The application is a step towards making BNB a legitimate investable digital asset in the traditional financial markets. At a time when the SEC has identified BNB in the past as a potential security, this filing is timely.

Yet, VanEck is pressing ahead after its Bitcoin and Ethereum ETFs proved successful. The proposed ETF would track the price of BNB, the native token of the Binance ecosystem. It is now used for more than the Binance exchange, such as payments, DeFi, and gaming platforms.

The market reaction to the filing was muted, even though it is a significant move. The price action stayed within a tight range, and there was no considerable spike or sell-off after the announcement.

Mixed Sentiment as Inflows and Smart Money Diverge

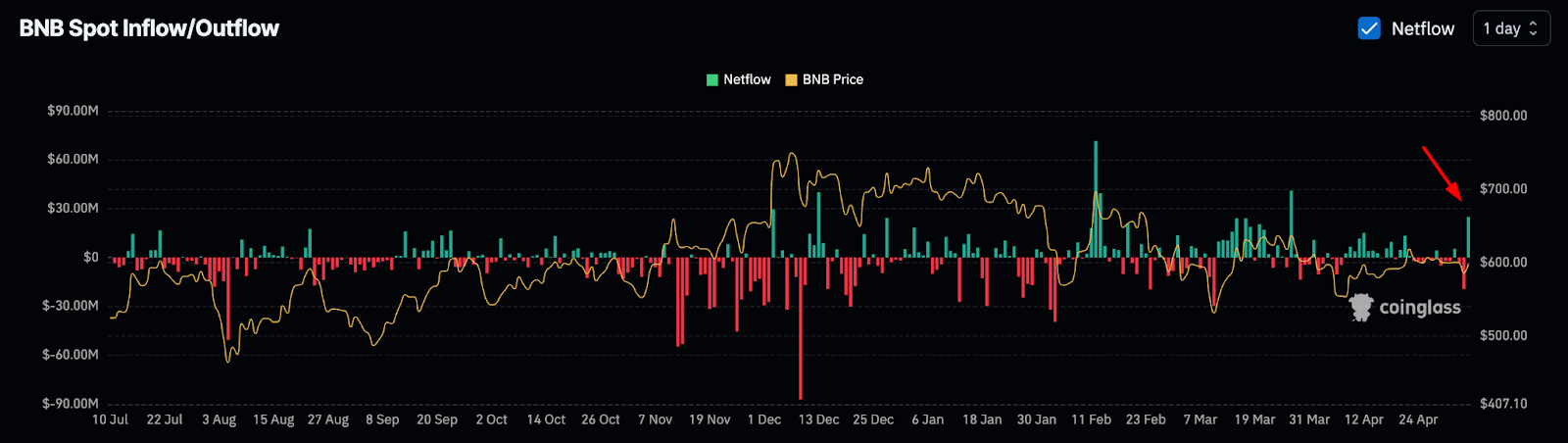

According to Coinglass on-chain data, BNB spot exchange flows have shown a noticeable change. Recently, the inflow was recorded as one of the most significant daily net inflows in recent weeks.

Whether this uptick is selling pressure or renewed interest in centralized holdings will depend on broader market activity.

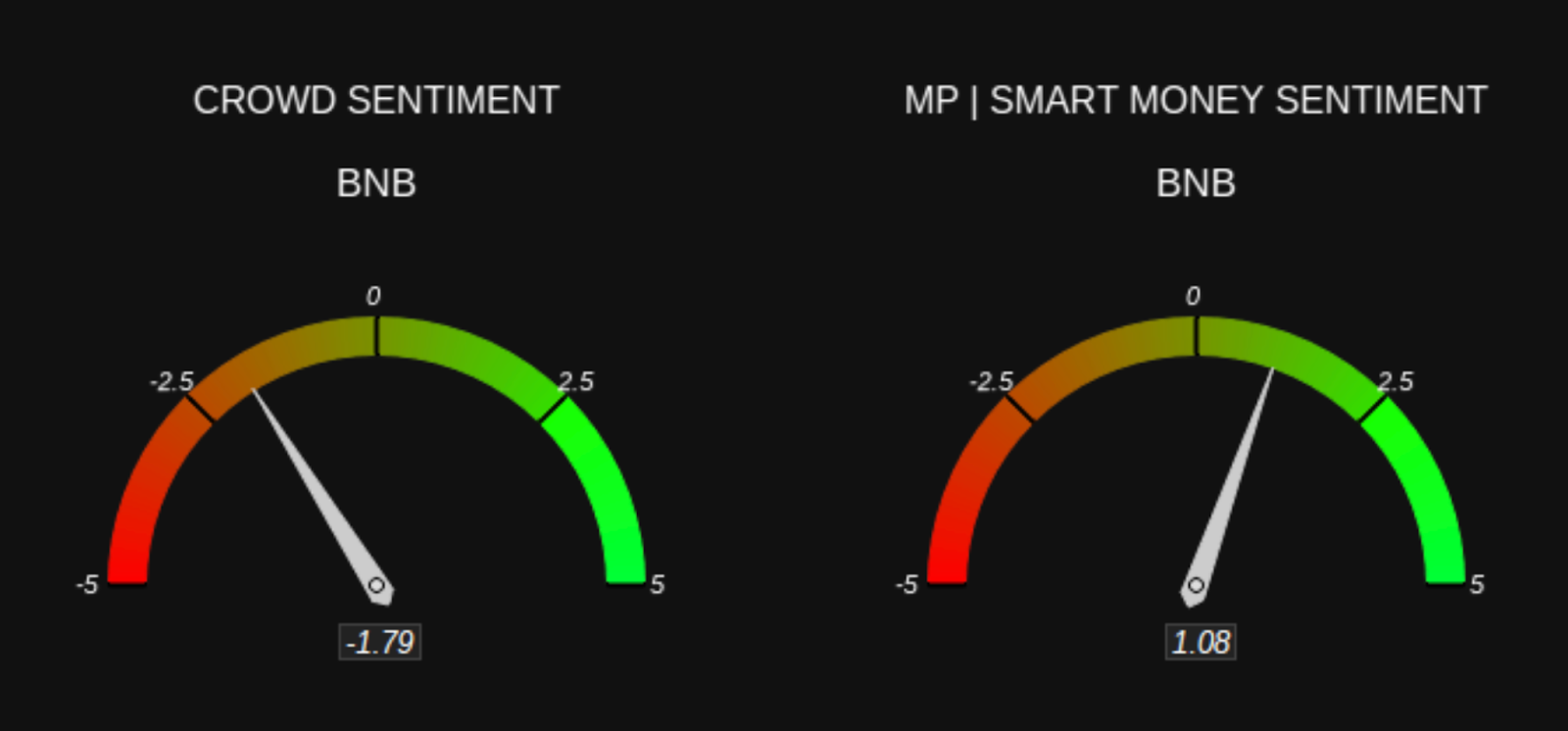

Despite this inflow, sentiment is divided. Market Prophit’s crowd sentiment stands at -1.79, a sign of mild bearishness among retail participants.

On the other hand, the smart money sentiment was 1.08. This indicated that institutional or experienced investors are more confident in this stock.

This could be a divergence from cautious optimism in the market. Larger investors may take a position for potential upside if key resistance levels are broken. However, the average trader remains skeptical.

Short-Term Chart Shows Potential for Bullish Break

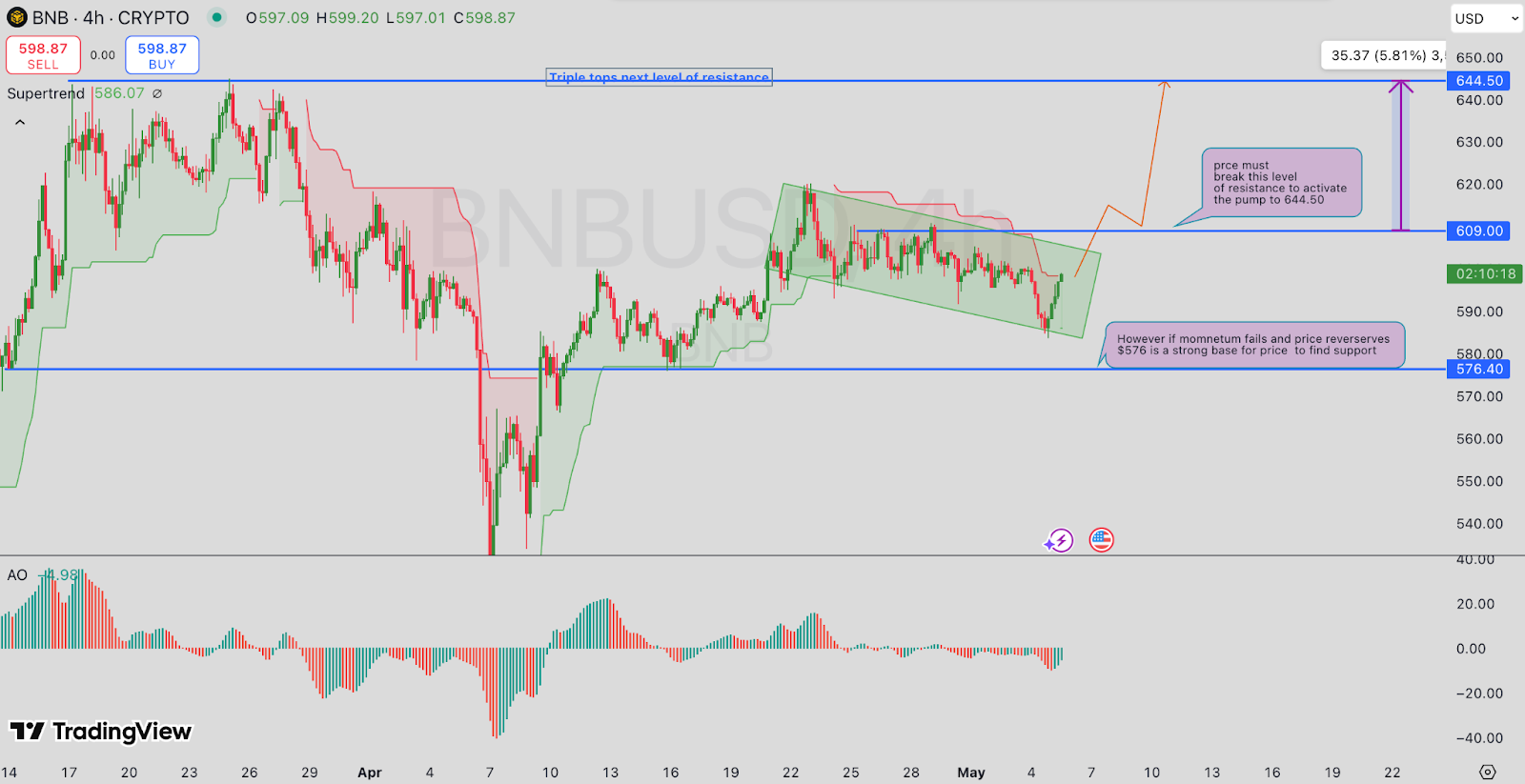

The 4-hour chart has a clear consolidation channel between $586 and $617, with short-term momentum turning up. BNB was close to the upper trendline of the falling channel and is currently trading just below $600.

A close above $609 would activate the bullish scenario toward $644.50.The Awesome Oscillator has crossed above the zero line, indicating a mild bullish bias. However, the signal is not strong enough to confirm a breakout yet.

If BNB fails to maintain its current levels and reverses, then $576 is expected to act as support again. This level has served as a price floor throughout April and early May. As such, traders look at both ends of this range for confirmation.

At press time, the market cap of BNB stood at $84.36 Billion, according to CoinMarketCap. Its 24-hour trading volume reached $1.48 Billion, a 16.12% increase.

The rise in trading volume is driven by growing interest in the ETF news. Key technical levels have also attracted heightened market activity. The filing does not mean approval is a given. However, it does indicate increasing institutional interest in the Binance ecosystem.

Disclaimer

This article is for informational purposes only and provides no financial, investment, or other advice. The author or any people mentioned in this article are not responsible for any financial loss that may occur from investing in or trading. Please do your research before making any financial decisions.

The post BNB Price Prediction: Break Above $620 Could Trigger Bull Run appeared first on The Market Periodical.