Key Insights :

- Cardano price traded in a $0.67–$0.72 range before testing key resistance at $0.73.

- Analysts forecast a breakout to $1.60 if ADA clears the upper wedge trendline.

- ADA futures show positive funding, reflecting growing confidence among bulls.

Cardano price has continued to trade within a narrow range. However, analysts suggest the token may be on the verge of a major breakout. A decisive move above the $0.73 resistance level could trigger a sharp rally, with short-term targets at $1.00 and $1.60.

Bullish patterns are emerging across multiple timeframes, strengthening market confidence. Growing positive sentiment in the derivatives market suggests the consolidation of ADA may soon shift into upside acceleration.

Cardano Price Holds Tight Range Below $0.73 Resistance

Over the past week, Cardano price maintained a stable trading range between $0.67 and $0.72. Cardano price action signals market indecision, with traders weighing potential moves.

It has posted a 2.3% daily gain, but remains slightly down 1.1% over the past week, reflecting mixed sentiment. Despite the limited movement, the token’s technical setup suggests that a larger move is developing.

On May 1, ADA price tested $0.70 again, approaching a key resistance level at $0.73. Token Talk’s TradingView analysis highlights a key resistance level for the top altcoin.

A successful break and close above this barrier could signal a new upward trend. The price may aim for the $1.60 target in the short term.

The projected long-term potential of $10 remains speculative. However, the near-term focus has shifted to whether the Cardano price can trigger a bullish breakout from its consolidation zone.

Wedge Pattern and Flag Formation Build Bullish Case

Furthermore, technical analyst CobraVanguard identified a falling wedge or bullish flag pattern on the 3-day ADA/USDT chart.

ADA price surged from $0.30 to over $1.30 between November and December 2024. This sharp increase created a textbook flagpole formation, signaling strong bullish momentum.

The downward-sloping channel forms the flag portion of the pattern, signaling consolidation. Cardano price oscillates between $0.90 resistance and $0.56 support, shaping the next breakout potential.

A breakout above the wedge’s upper trendline could activate the continuation structure. It could target $1.3387, an estimated 89% rally from $0.7076.

CobraVanguard emphasized the importance of waiting for confirmation, noting that price action remains trapped between key horizontal levels. If the wedge breakout occurs, it may fuel a stronger continuation of ADA’s broader uptrend.

Smart Money Concepts Reveal Market Structure

Analyst Arman Shaban offered additional context by analyzing ADA’s 3-day chart using Smart Money Concepts. He observed a complete market structure cycle, tracking the surge of ADA from $0.33 to $1.32.

However, Cardano price encountered rejection near a Bearish Order Block, signaling a potential shift in momentum.

As price retraced, it landed in a demand zone around $0.50, supported by a Bullish Order Block and a filled Fair Value Gap. The recovery from this zone propelled the Cardano price back above $0.70.

Shaban outlined key target zones at $0.75, $0.81, $0.93, and $1.05, highlighting areas where sellers could return or liquidity may build.

Futures Market Signals Strengthening Bullish Sentiment

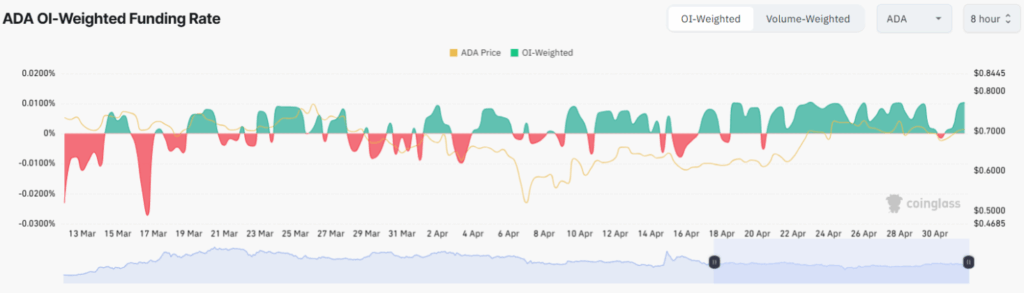

Beyond chart patterns, the derivatives market further reinforces the bullish setup. According to Coinglass data, Cardano’s OI-Weighted Funding Rate has remained consistently positive since mid-April.

Long-position traders have been paying short-position holders, shaping the market’s balance. This dynamic signaled strong confidence in further price appreciation across the broader market.

The rise of the Cardano price from $0.61 to above $0.70 occurred in parallel with growing open interest and bullish funding. This suggests that both spot and futures traders are positioning for an upward move.

The synchronized increase in funding and price indicates organic accumulation rather than isolated speculative spikes. This makes the current rally potentially more sustainable.

Break Above $0.73 Could Trigger Rally Toward $1.60

Cardano’s market setup is bullish, supported by multiple timeframes, historical chart structures, and strong derivatives participation. Analysts agree that a breakout above $0.73 is crucial for ADA to unlock upside potential.

If confirmed, the price could target $0.93 in the medium term and $1.60 soon. ADA price could break out of its months-long consolidation if volume and funding keep trending upward. This momentum could drive a stronger move higher in 2025, signaling renewed bullish activity.

Disclaimer

This article is for informational purposes only and provides no financial, investment, or other advice. The author or any people mentioned in this article are not responsible for any financial loss that may occur from investing in or trading. Please do your research before making any financial decisions.

The post Cardano Price Eyes $0.73 Breakout: Will It Ignite A Rally To $1? appeared first on The Market Periodical.