Ethereum faced a notable increase in buying pressure, leading to a bullish rebound at the crucial $1.5K support. The price faces a decisive resistance range at $1.8K, expected to enter a short-term consolidation before breaking above it.

Technical Analysis

By Shayan

The Daily Chart

After a period of muted price action and market inactivity around the decisive $1.5K long-term support region, Ethereum eventually experienced a surge in buying pressure, triggering a bullish rebound. This wave of demand has pushed the price toward the significant $1.8K resistance zone. This area coincides with an important order block, where smart money typically places orders, reinforcing its significance.

The price action at this level is critical; a successful breakout above $1.8K would likely confirm a bullish reversal scenario, opening the path toward the $2.1K target. However, short-term consolidation around this resistance is probable before a decisive move unfolds.

The 4-Hour Chart

On the lower timeframe, ETH’s previous tight-range consolidation was broken by a notable influx of buyers, resulting in an impulsive breakout above the descending channel. This breakout was accompanied by strong bullish momentum, driving the price toward the key $1.8K resistance zone.

This region aligns with Ethereum’s prior swing lows, making it a robust supply area. As a result, short-term consolidation is expected at this level until demand or supply pressure determines the next move. A bullish breakout above $1.8K would set the $2.1K range as the next likely target for buyers.

Sentiment Analysis

By Shayan

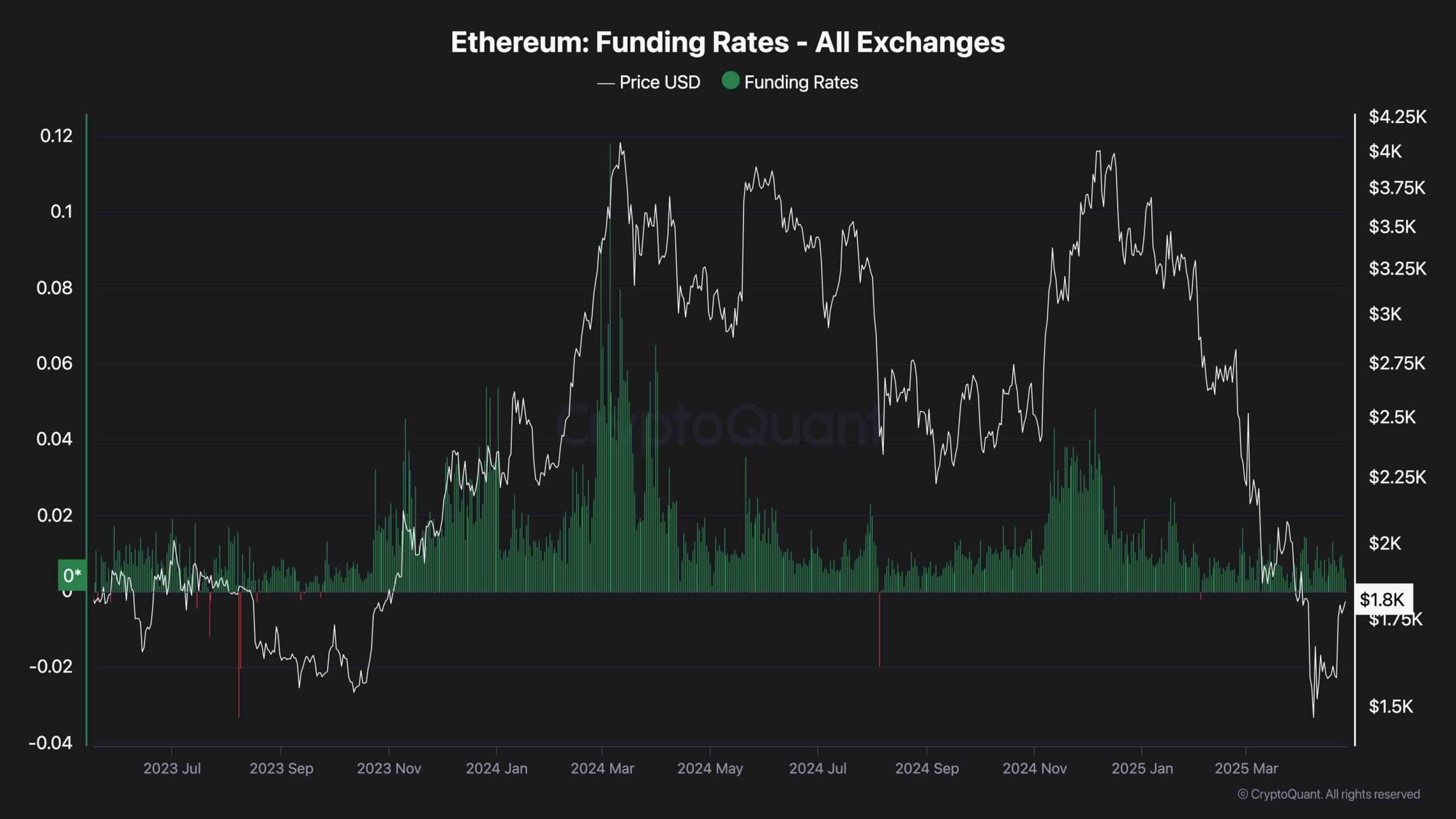

The funding rates metric is a crucial indicator of sentiment in the futures markets. Analysing its recent behaviour provides important insights into Ethereum’s latest surge. Typically, healthy and sustainable bullish trends are accompanied by rising funding rates, signalling an influx of buyers in both the perpetual futures and spot markets.

Currently, however, funding rates are consolidating and showing no significant increase. This suggests that Ethereum’s recent price surge has primarily been driven by spot market buying rather than futures market speculation. For this bullish trend to be validated and gain persistence, the funding rates metric needs to start rising, reflecting growing confidence and aggressive buying in the futures market as well.

The post Ethereum Price Analysis: What’s Next for ETH After Surge to $1.8K Resistance? appeared first on CryptoPotato.