Dogecoin has been trading in a tight range lately, with its price movement increasingly narrowing over the past few days between $0.15 and $0.16. This increasingly narrowing range comes off a wider downside consolidation move since the beginning of April, which has led to the creation of a triangle pattern on the 4-hour candlestick timeframe chart.

As it stands, Dogecoin is trying to recover from earlier losses in April, and a recent higher low points to growing bullish activity that could send it pushing above the upper trendline of the triangle pattern in the coming week.

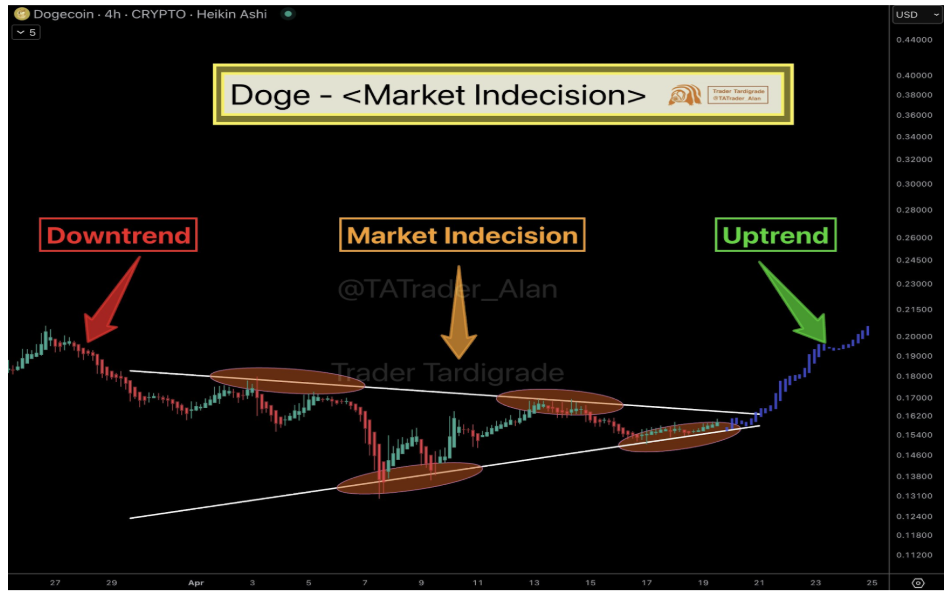

Analyst Notes Classic Market Indecision In Dogecoin Structure

Crypto analyst Trader Tardigrade recently brought attention to Dogecoin’s current price structure in a post shared on the social media platform X, noting a converging triangle formation that reflects growing indecision in the market.

According to his analysis, Dogecoin’s price action has transitioned from a clear downtrend (visible throughout late March and extending into the first week of April) into a state of consolidation that has persisted over the past two weeks.

Looking at the resulting triangle formation on the 4-hour candlestick timeframe chart, it is easy to infer that both buyers and sellers are exercising caution. Buyers are reluctant to enter at higher levels, while sellers seem unwilling to push prices lower, creating a narrowing band of price action since April 15. The result is a compression of volatility, which could break out in either direction.

What Comes After The Indecision Phase?

As shown in the Dogecoin price chart above, the memecoin is now approaching the tip of the triangle. In this particular case, the structure leans toward a bullish breakout, with market behavior showing signs of upward pressure building beneath the surface by a 2.77% increase in trading volume in the past 24 hours.

Trader Tardigrade projected an uptrend that cancels out the downtrend in late March, following the classic pattern of a downtrend, indecision, and a resulting uptrend.

A strong bullish candle that closes above the upper trendline of the triangle is important to validate the predicted uptrend. Trader Tardigrade’s projection shows that if such a move occurs, Dogecoin could reclaim the $0.20 level within a relatively short time frame before the end of the month.

Dogecoin opened the month of April at $0.166. As such, a clean upside breakout followed by a sustained close above $0.20 would mark a positive finish for Dogecoin in April.

Such a positive monthly close would likely influence market sentiment heading into May and possibly invite increased buying activity. It would also help confirm that the recent period of bearishness is over and help reestablish a bullish structure.

At the time of writing, Dogecoin was trading at $0.1573

Featured image from 21Shares, chart from TradingView