Bitcoin fell below the $80,000 mark on Sunday as investor sentiment weakened across global markets. The move came alongside a spike in daily liquidations, which totaled $590 million.

Heightened anxiety over former President Donald Trump’s proposed tariffs and escalating geopolitical tensions weighed heavily on risk assets.

More Traders are Shorting Bitcoin After the Worst Q1 In a Decade

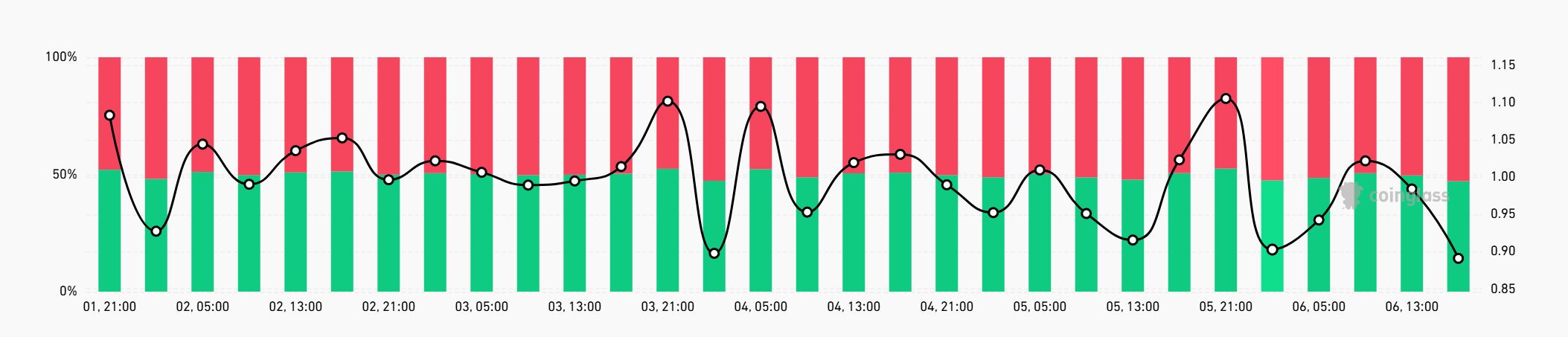

The long-short ratio for Bitcoin dropped to 0.89, with short positions now accounting for nearly 53% of activity. The shift reflects growing skepticism about Bitcoin’s short-term direction.

Traditional markets also suffered sharp losses. The Nasdaq 100, S&P 500, and Dow Jones all entered correction territory last week, posting their worst weekly performance since 2020.

Bitcoin closed the first quarter with a loss of 11.7%, making it the weakest Q1 since 2014.

The broader crypto market lost 2.45% on Sunday, reducing total market capitalization to $2.59 trillion. Bitcoin remains the dominant asset, holding 62% of the market share. Ethereum follows with 8%.

Sunday’s selloff triggered $252.79 million in crypto derivatives liquidations. Long positions made up the bulk of that figure at $207 million. Ethereum traders accounted for about $72 million in long liquidations alone.

Bitcoin’s price remains closely tied to shifts in global liquidity, often reflecting broader macro trends. With U.S. markets set to open Monday, this weekend’s activity signals continued volatility ahead.

Investors may face more pressure after Federal Reserve Chair Jerome Powell warned that Trump’s tariff plans could push inflation higher while slowing economic growth.

That combination raises the risk of stagflation, a situation where policy tools become less effective. Efforts to stimulate the economy can worsen inflation, while measures to control prices can limit growth.

The post Bitcoin Falls Below $80,000 as Weekend Liquidations Exceed $590 Million appeared first on BeInCrypto.