Key Insights:

- Tether’s $735M Bitcoin purchase shows growing institutional confidence.

- Bitcoin holds strong support at $72K, signaling possible breakout.

- Accumulation by large players suggests the correction phase may be over.

The latest Tether Bitcoin purchase has fueled optimism among market watchers. As Bitcoin (BTC) continues to trade above key support, new whale inflows and institutional buying suggest that the recent correction phase could be nearing its end.

The purchase has fueled discussions about Bitcoin’s market trajectory, with some analysts suggesting that the correction phase for Bitcoin may soon come to an end.

Tether Bitcoin Purchase Signals Long-Term Confidence

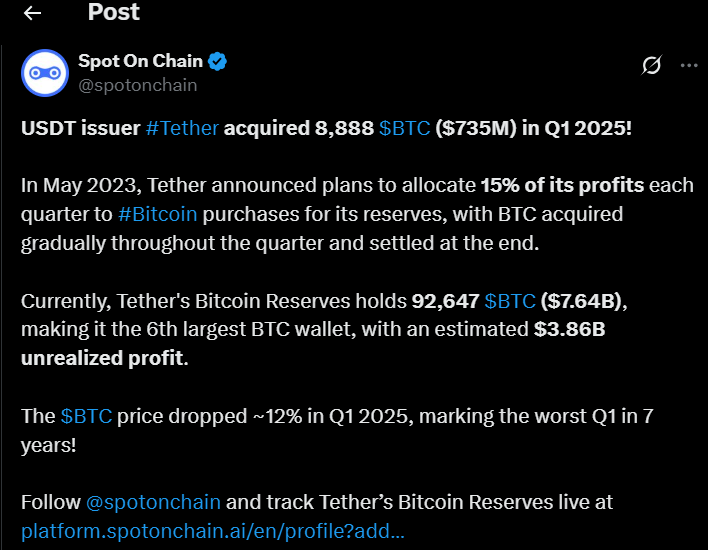

In the Q1 2025, Bitcoin market volatility remained and its purchase of nearly 9,000 Bitcoin is a growing sign of institutional confidence in Bitcoin. Tether’s plan, since last year, was to buy Bitcoin in the market with 15% of profits each four months and this is a continuation of that plan. With the latest addition, the total amount of BTC held by Tether rises to 92,647 BTC, approximately $7.64 billion.

The Tether Bitcoin purchase is part of its broader strategy to invest 15% of net profits into BTC every four months. Despite Bitcoin falling 12% in Q1, Tether increased its holdings, showing strong conviction during a weak market.

With over 92,647 BTC now in reserve—worth more than $7.6 billion—Tether continues to back the asset as a long-term hedge. Its consistent buying has become a key signal for institutional interest.

Strong Support at $72K for Bitcoin

Adversity from a descending trendline for Bitcoin has only swept it further up from the $72,000 mark or so, which acts as a key support. BOBOObtc, market analyst, observes that this price zone has seen several tests during the past year, adding to its relevance.

The reason being, is that Bitcoin has remained above this level, which indicates that the asset is gaining more strength, likely ready to have a breakout after the downward trendline is broken.

As Bitcoin continues its bull trajectory if $72K keeps, then this remains bullish. If Bitcoin is able to overcome the descending trend line, analysts expect the price to surge to higher levels, with a target of as high as $100,000. High resilience above $72,000 still keeps a positive attitude despite the market corrections.

Whale Accumulation Could Signal a Strong Rally

In addition to Tether’s large Bitcoin acquisition, whale activity in the market has also been a point of focus. According to market analyst CryptoCove, big players are accumulating Bitcoin while waiting for a dip, signaling confidence in the digital asset’s future price movements. On March 31, Strategy founder Michael Saylor acquired 22,048 BTC ($1.92 billion) at an average price of $86,969 per Bitcoin.

The increasing whale accumulation, especially in the face of a prolonged correction phase, suggests that these players are positioning themselves ahead of a potential breakout. If Bitcoin continues to maintain its support levels and breaks through resistance zones, analysts predict a strong rally could be imminent, with targets potentially reaching $109,000.

Open Interest Shows Increased Market Participation

The latest data on Bitcoin’s open interest reveals an upward trend in market participation, with open interest rising by 1.80% in the past 24 hours.

Perpetual contracts saw an even more significant increase of 1.99%, indicating greater activity in long-term contracts. While futures contracts saw a slight dip of 0.42%, the overall increase in open interest points to a growing interest in Bitcoin’s price movements.

Rising open interest alongside continued whale buying, including the Tether Bitcoin purchase, supports a growing consensus that market sentiment may be shifting.

Disclaimer

This article is for informational purposes only and does not provide any financial, investment, or other advice. The author or any people mentioned in this article are not responsible for any financial loss that may occur from investing in or trading. Please do your research before making any financial decisions.

The post Tether Bitcoin Purchases $735M Bitcoin—Is the Correction Over? appeared first on The Market Periodical.